Value Added Tax (VAT) UAE

The UAE government implemented the Value Added Tax (VAT) on January 1, 2018.

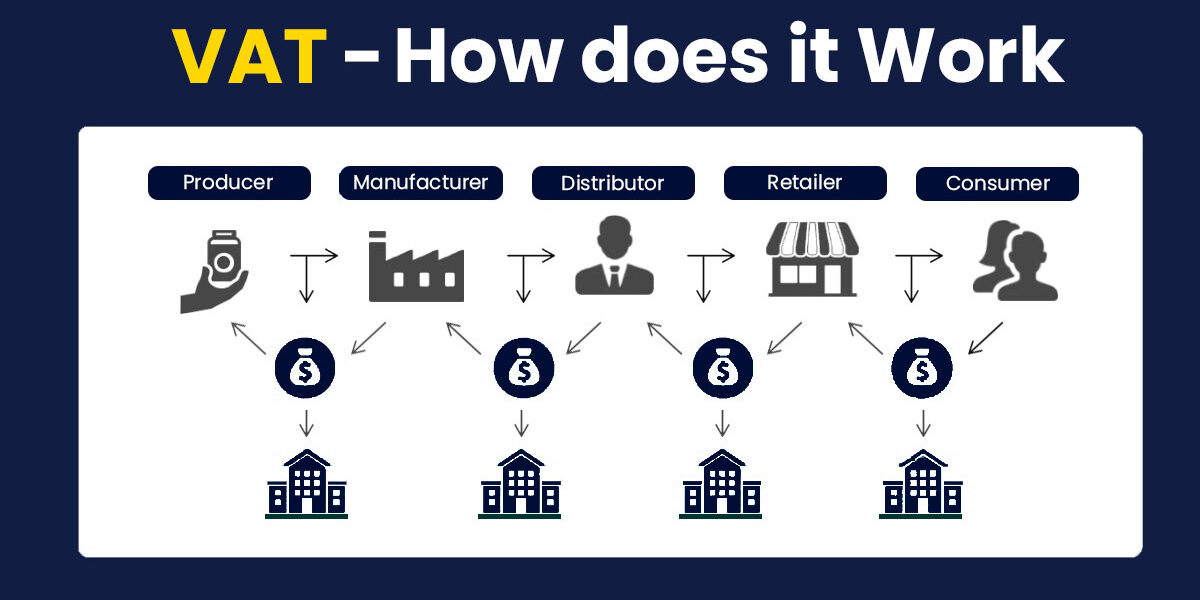

“UAE imposes VAT on registered businesses at a standard rate of 5% on a taxable supply of goods or services at each stage of the supply chain. VAT is levied on the consumption/use of goods and services and the end-consumer is the ultimate bearer of the cost of tax.”

“If you are a VAT registrant you can claim back the tax which you paid on your purchase, expenses and input services and it also improves the business image. If you are not a VAT registrant you still have to pay the VAT on your purchases but are unable to reclaim it from FTA. The companies must apply for the TRN before your business crosses the threshold this will save you from huge penalties.”

1. What is VAT?

Value Added Tax (VAT) in Dubai UAE refers to the Indirect tax imposed on commodities which can be equated to the type of universal consumption tax enforced on the consumption of goods & services. That is a comprehensive multistage consumption tax, taxed the supply chain transversely as well as collected by companies on behalf of the government.

Tax collected on Sales- Tax paid on purchase = VAT Payable/(VAT Refundable)

2. Registration for TRN with Federal Tax Authority (FTA)

Criteria for registering for VAT – Mandatory Registration: A business must register for VAT if its taxable supplies and imports or taxable expenses exceed AED 375,000 during last 12 months.

Voluntary Registration : It is optional for businesses to apply for registration whose taxable supplies and imports or taxable expenses exceed AED 187,500 but do not exceed AED 375,000 during last 12 months.

Taxable supplies: For the purposes of understanding whether a registration obligation exists, a taxable supply refers to a supply of goods or services made by a business in the UAE that may be taxed at a rate of either 5% or 0%. Imports are also taken into consideration for this purpose, if a supply of such goods or services would be taxable if made within the UAE.

A business house pays the government the tax that it collected from the customers, but at the same time it receives a refund from the government on tax that it has paid to its suppliers in the form of adjustment against tax collected from customers.

3. How to register for VAT?

The application needs to be filled by providing certain documents and information as required. After providing all the required documents and information, FTA may issue the Tax Registration Number (TRN) within 20 working days. Team Elevate has successfully registered more than 5000 companies with FTA for their VAT (TRN).

Elevate can register any eligible Business for obtaining a TRN number. We have a certified team with appropriate qualification who can take care of the VAT Registration Process.

For Value Added Tax (VAT) in UAE, we collect the documents and information that are required for VAT registration and fill the form after creation of user id and password and follow-up for the status after submitting the form for registration.

4. On which businesses does VAT apply?

VAT applies equally on tax-registered businesses managed on the UAE mainland and in the free zones. However, if the free zone falls under the list of designated zones that have been approved by UAE Cabinet, there is a separate set of VAT rules that are applicable.

5. Is there any penalty on non-filing of VAT Return?

If a VAT registrant fails to file a tax return within the specified timeline, he will pay AED 1,000 in fine for the first offense and AED 2,000 for repetition within 24 months.

A minimum penalty of 2% for first one week of the payable amount, then 4 % for first one month, then 1 % per day of the payable amount , but not more than 300 % of the tax value .

What is the due date for filing VAT Return?

Due date to file VAT return is 28th of following month, when quarter ends. Some companies also have a VAT filing every month.

6. How to make payment on VAT

Through:

• With an e-Dirham Card or a credit card (Visa & Master card only) Charges for payment through e-Dirham card -AED 3 per transaction Charges for payment through credit card- 2-3% of the payment.

• With a bank transfer or each taxable person is provided with unique identification number called a GIBAN, which can be used to make a bank transfer, just add GIBAN as beneficiary.

• With eDebit.

This mode of payment takes time. This option works only for taxable persons who have access to certain retail or corporate online banking.

- VAT Payment through Money Exchange (Al Ansari Exchange)

7. How to file VAT return?

Businesses must file tax return electronically through the FTA portal: eservices.tax.gov.ae. Before filing the VAT return on the portal, make sure you have met all tax returns requirements. VAT Filing can be accurate if Accounting is done properly. Also the Accountant should have thorough knowledge of UAE VAT treatment. At Elevate first certified VAT Compliance Diploma holders handle VAT Filing in UAE.

Failure to file a tax return within the specified time frame will make the violator liable for fines as per the provisions of Cabinet Resolution No. 40 of 2017 on Administrative Penalties for Violations of Tax Laws in the UAE.

Elevate has a team of professionals who can review the sales and purchase transactions of business and arrive to the amount of tax payable for a particular period and assist in filing the VAT return within time to avoid any late VAT return filing penalty. We can visit your office and go through full transactions and advise on any developments that are required with respect to compliance of VAT law like preparation of Tax invoice, recording of transactions and maintenance of sufficient records as required by the law or you can visit our office.

If you are registered for VAT in UAE, as per UAE Federal law no-2 of 2015 you have to keep proper books of accounts for minimum period of 5 years as per FTA Law.

8. VAT Audit in Dubai, UAE ?

Elevate as an Auditing company with a professional team with excellent knowledge of VAT,

- We will conduct our VAT audit in accordance with UAE Federal Decree Law No. (8) of 2017 along with the executive regulations and cabinet decisions issued by the Federal Tax Authority.

- Our VAT audit will involve a critical evaluation of VAT returns filed in the subject period and ensuring the compliance of applicable laws and regulations.

- The transactions will be selected on a sample basis for each quarter and the same will be verified thoroughly from VAT perspective in terms of treatment and documentation.

- If we identify issues of non-compliance with the laws and regulations, we will bring such matters attention to the appropriate level of management.

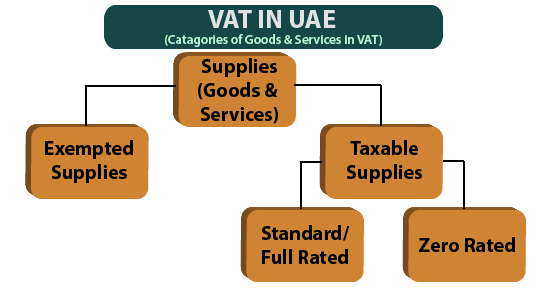

Rates of VAT

Standard rate: The businesses registered under UAE VAT will be levied 5 percent tax.

Zero rate:

- Exports of goods and services outside the UAE

- International transportation, and related supplies

- Supplies of certain sea, air and land means of transportation (such as aircraft and ships)

- Certain investment grade precious metals (e.g. gold, silver, of 99% purity)

- Newly constructed residential properties, that are supplied for the first time within 3 years of their construction

- Supply of certain education services

- Supply of certain Healthcare services

Areas exempted from VAT:

- Supply of certain financial services

- Residential properties – sale and lease

- Bare land – sale and lease

- Local passenger transport

Out of scope transactions for VAT:

These are mostly high sea sales kind of transactions wherein a UAE distributor ships goods from one country to another directly, which doesn’t involve any direct involvement with UAE. Such types of transactions are out of scope for VAT and need not follow the registration and compliances.

OUR VAT SERVICES INCLUDE THE FOLLOWINGS:

1. VAT Registrations

2. VAT Return filings.

3. VAT Refunds.

4. VAT registration.

5. VAT Voluntary disclosure.

6. VAT Reconsideration.

7. Vat deregistration service

8. VAT Audit

9. Liaison with FTA on their tax-related matters

For all VAT Services related queries

Call Now

Mr. Parth

Phone: +971 (0) 561672533