Excise Tax in Dubai, UAE

EXCISE TAX

Excise Tax is a form of indirect tax levied on specific goods that are harmful to human health or the environment with and objective to reduce consumption of these harmful products.

Unlike VAT, Excise tax is paid only once by the producer of goods when goods are released for consumption. Once tax is paid, the product is sold throughout the supply chain with “Tax paid status” and it is ultimately passed to end consumer.

EXCISE TAX REGISTRATION

Any business which imports, produces or stockpiles excise goods, or releases them from a designated zone in the UAE, should register for Excise Tax. There is no registration threshold for Excise Tax.

When to register:- You have a liability to be registered within 30day from the end of the month in which you formed the intention to import, produce or release goods from a designated zone.

Late registration:- If you fail to notify FTA within in the timeframe, FTA may collect the value of underpaid excise tax and may charge you administrative penalty.

Penalty for late registration – AED 20,000

You are not permitted to conduct any such activities unless you are registered for excise tax.

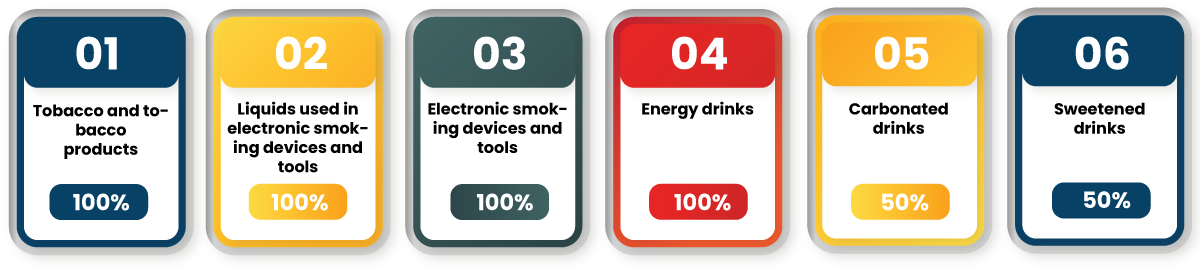

In UAE, Excise Tax is currently applied on the following goods at the given rates:

FILING EXCISE TAX RETURNS/FORMS AND MAKING PAYMENTS

Once you have registered for Excise Tax, you are required to file your Excise Tax return by the 15th day following the end of each tax period.

Excise Tax returns are automatically populated based on the information submitted in the following declaration forms during, or at the end of, the tax period:

- Excise Tax import declaration forms

- Excise Tax production declaration forms

- Stock piling declaration

- Designated zone reporting declaration

- Lost and damage declaration

- Deductible Excise Tax declaration

- Import declaration by Non registered importers

- Other declarations

Payment Methods - e-Dirham, Credit card, Bank Transfer – Local Transfer & International Transfer

Deductible Tax consists of:

- The Tax paid on Excise Goods which have been exported;

- The Tax paid on Excise Goods which have become a component of another Excise Good which is, or will become, subject to tax;

- Amounts paid to the Authority in error.

Excise Tax Refund:

- Where the value of a Taxable Person’s deductible tax exceeds the value of excise tax payable to the FTA the Taxable Person can carry forward the excess refundable tax and offset it against his excise tax liability payable to the FTA in future tax periods. If the Taxable Person has excess refundable tax remaining after carry forward for next two tax periods, he can apply to the FTA for a refund through FORM - EX301 Excise Tax Refunds.

Excise tax Deregistration:

- You can apply for deregistration if you no longer engage in taxable activities. You will have to notify FTA within 30days of when your taxable activities ceased.

- You can deregister only if you have submitted all your excise returns and cleared all your excise tax amount and penalties due to FTA.

Record-Keeping and Evidential Requirements:

- The Taxable Person shall keep all the records prescribed by FTA.

OUR EXCISE TAX SERVICES

Team Elevate consist of professionals having in depth knowledge and practical experience in Excise tax can assist you in Excise Tax related matters.

- Excise Tax registration

- Product registration

- Filing monthly returns

- Filing refund application

- Filing declaration forms

- Deregistration

- Other consultancy services