Economic Substance Regulations - an initiative by Organization for Economic Co-operation and Development:

The United Arab Emirates has in coordination with the Ministry of Finance implemented Economic Substance legislation in order to comply with its commitment as a member of the OECD (to comply with EU’s requirements to be removed from the list of non-cooperative tax nations). The Economic Substance Regulations are applicable to all the Licensees within the UAE’s jurisdiction and include all Licensees operating within free-zones in UAE. Offshore Companies, any person or company holding a trade license or certificate of incorporation to carry out any business activity is coming under Economic Substance Regulations. This is in the benefit of the real investors in UAE & a company in UAE will have its Global value.

Because of zero corporate tax many global business house has opened their Head Offices in UAE. Sometimes the profit shifting to UAE is harmful and loss for countries where there is tax.

Economic Substance rules pointed at companies based in low tax jurisdictions such as Bahrain, Bermuda, BVI, Cayman Islands, Isle of Man, Jersey, Guernsey, Mauritius, Bahamas, Seychelles, and United Arab Emirates.

- Reporting income in low tax jurisdiction without any real economic activity and substance in that jurisdiction.

- Activities in relation to the income effectively take place outside of the low tax jurisdiction.

- Do you have group companies within UAE to/from which you accept or grant loan/advances?

- Do you have foreign group companies or branches?

- Have you invested in shares of any other company?

- Do you own any intangible assets?

- Does your employee count and tangible assets substantiate your top line?

Economic Substance Regulations

Objective is to avoid artificial/harmful “Profit Shifting” that is badly impacting the economy of Europe, America, India and many other countries where there is Corporate Tax.

Required reporting under the ESR is a means to monitor and achieve this goal, so just by opening a small company in UAE, companies can’t save tax.

The guidelines apply to companies that carry out any of the following Relevant Activities.

Relevant Activities

Banking Business

Insurance Business

Investment Fund Management Business

Lease – Finance Business

Headquarters Business

Shipping Business

Holding Company Business

Intellectual Property Business

Distribution and Service Center Business

Annual Notification & Economic Substance Report.

What All Licensees must follow.

- Notify if any Relevant Activities are carried out during reportable period

- If yes, indicate whether gross income in relation to Relevant Activity is subject to tax outside UAE

- If IP Business, indicate if also High-Risk IP Business.

Submission of Economic Substance Report within 12 months after FY-end

- Type(s) of Relevant Activity

- Amount and type of income, OPEX and assets

- Number of employees with qualifications

- Information regarding CIGA’s performed

- Declaration whether Economic Substance test is met

- Further information in case of High-Risk Intellectual Property Business

- Further information if Relevant Activity is outsourced

Amendment in Economic Substance Regulations in UAE:

An Exempted Licensee includes any of the following entities registered in the UAE and which carry out a Relevant Activity:(a) an Investment fund

(b) an entity that is tax resident in a jurisdiction other than the UAE

(c) an entity wholly owned by UAE residents and meets the following conditions:

(i) the entity is not part of a MNE Group

(ii) all of the entity’s activities are only carried out in the UAE

(d) a Licensee that is a branch of a foreign entity the Relevant Income of which is subject to tax in a jurisdiction other than the State.

Exclusions from the definition of Licensee are: Natural persons, Sole proprietors, Trust and Foundations. Therefore, they do not need to file a notification or meet the ES Tests.

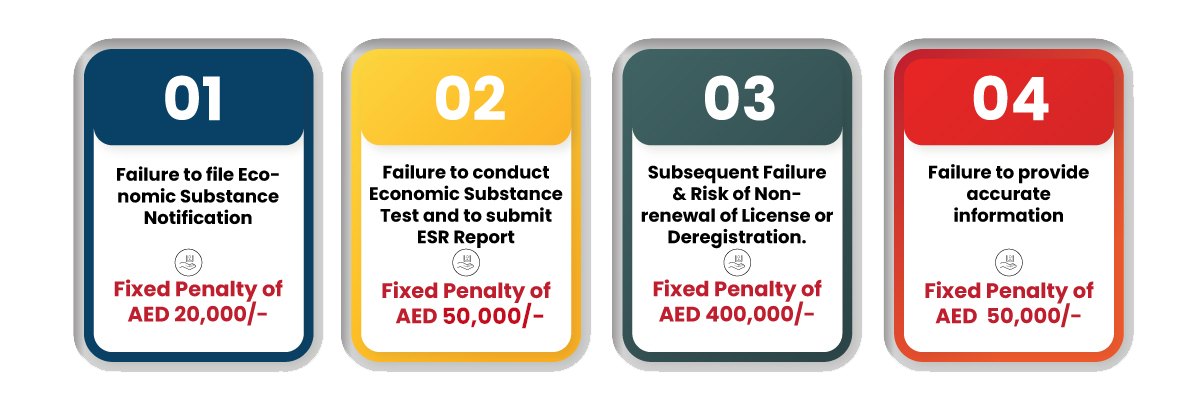

Penal Provisions

What Elevate Can do for you.

Our professional Tax consultants will understand the structure of the group and do the assessment of requirements of the new Economic Substance. Team Elevate will help you to be compliant in UAE.

- We can take care of the Annual Notification

- Economic Substance Test (When Relevant Activity is Performed)

- Economic Substance Report