[vc_row][vc_column][vc_column_text]

In compliance with the Private Companies Regulations of 2016, FZLLCs and branch offices are required to submit their most recent Audited Financial Statement along with the summary sheet (as per the DDA template) by or before 30th November, 2022 or the due date as mentioned in their AXS portal. Thereafter, all companies are required to submit their Audited Financial Statement within six months from the financial year-end. A branch office may choose to submit the consolidated audited financial statement of its parents or a stand-alone extract of the financials of the branch office operation only.

Elevate First Accounting & Auditing is one of the registered auditors in DDA & TECOM serving already more than 300 companies registered under DDA. We can assist you to prepare the Audited Financial Statement (AFS) as per DDA requirements to enable you to submit it before the deadline thus avoiding unnecessary fines & penalties.

Newly registered companies

Newly registered companies that have not completed their first financial year are required to provide the Audited Financial Statement within six months from their first financial year-end.

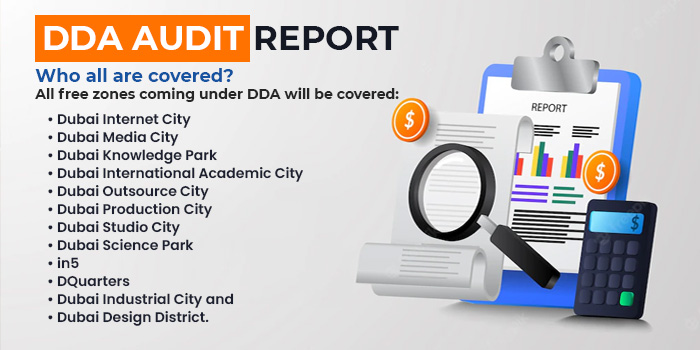

DDA Audit Report

DDA has mandated the companies operating under its license to submit the latest audited financial statement along with the summary sheet in the prescribed format given by DDA on or before 30th November, 2022 for the last financial year and thereafter within six months from the end of the financial year. The DDA Audit Report along with the summary sheet must be submitted through the AXS portal to the DDA. The requirements of the Audited Financial Statement for an FZLLC are provided in Regulations 63-68 of the Private Companies Regulations of 2016. The summary sheet submitted should include the following information:

- Profit & loss statement: Revenue cost of revenue, gross profit/loss, operating costs, operating profits, interest expenses, depreciation, amortization, other income, and net profit/loss.

- Balance sheet: Fixed assets, investments, current assets, other assets, equity, long-term liabilities, and current liabilities.

The above submission is applicable to FZ LLCs and Branch companies and not applicable to freelancers. Non-submission of the DDA Audit Report can lead to non-renewal of licenses along with other penalties.

Procedures for the DDA Audit

As stipulated for every external/statutory audit, the process covers all aspects to ensure compliance with the relevant laws, as for DDA which will be the DCCA regulations (Dubai Creative Clusters Private Companies Regulations 2016), and an in-depth analysis of the financial information presented. Our team of DDA approved auditors ensures that requirements as per International Financial Reporting Standards (IFRSs), International Standards on Auditing (ISAs), and relevant legal frameworks are properly complied with. The procedures we follow cover the following stages:

- Initial planning to understand the scope of work and relevant document requirements.

- Execution of our audit procedures to verify and review the required information.

- Preparation and discussion of the draft audit report.

- Issue of the final audit report as per the DDA template.

Documents required for DDA Audit Report

- Basic legal documents of the company.

- Financial statements extracted from the books of accounts (Balance sheet, Income statement & Trial balance).

- Bank statements.

- Such other relevant documents as requested by the auditor.

The growing importance of maintaining the financial records for any external audit to be effective, maintaining proper books of accounts and relevant supporting documents is very crucial. With the existing tax laws and upcoming corporate tax, this requirement is getting concrete as all the licensing authorities along with the tax authorities will mandate the submission of audited financial statements on an annual basis to closely monitor the activities of the businesses operating in its land.

DDA Companies need an Audit Report for the TRC application from FTA. Nowadays many DDA companies are bidding on government tenders, trying to get business from ADNOC and the large governmental and semi-governmental organizations. In this case, they need ICV Certification. Auditing in DDA companies along with proper accounts are mandatory to obtain ICV certification.

Other than this those thousands of companies having their DDA license require Audit reports sometimes to be submitted to FTA, and an audit report to get a bank facility from any bank.

Thus ensuring your books of accounts is prepared and maintained up to date is the foundation to cope with the rapidly advancing legal outlook of the UAE economy.[/vc_column_text][/vc_column][/vc_row]