In the ever-evolving business landscape of Dubai, the role of accounting and bookkeeping services cannot be taken lightly anymore . These functions are not mere necessities for regulatory compliance but serve as the foundation for strategic decision-making and sustainable growth. For businesses without an in-house accounting team, the solution lies in outsourcing, and Elevate Accounting & Auditing emerges as a distinguished service provider, offering a comprehensive suite outsourced accounting services in Dubai tailored to meet the diverse needs of businesses across various sectors.

What is Accounting & Bookkeeping?

At its core,

- Accounting involves the systematic recording, classification, and interpretation of financial transactions, providing a holistic view of an organization’s financial health.

- Bookkeeping, a subset of accounting, focuses on the meticulous recording of financial transactions to maintain accurate and organized financial records.

What is Outsourcing Accounting and Bookkeeping Services?

Outsourcing accounting and bookkeeping services involve entrusting these critical financial functions to external experts. Elevate Accounting & Auditing, boasting a team of professional Chartered Accountants and CPAs, distinguishes itself by maintaining industry standards in delivering precise and timely accounting reports. Their expertise spans diverse industries, encompassing F&B, Manufacturing, Education, Pharmaceutical, Retail, Restaurants and Construction.

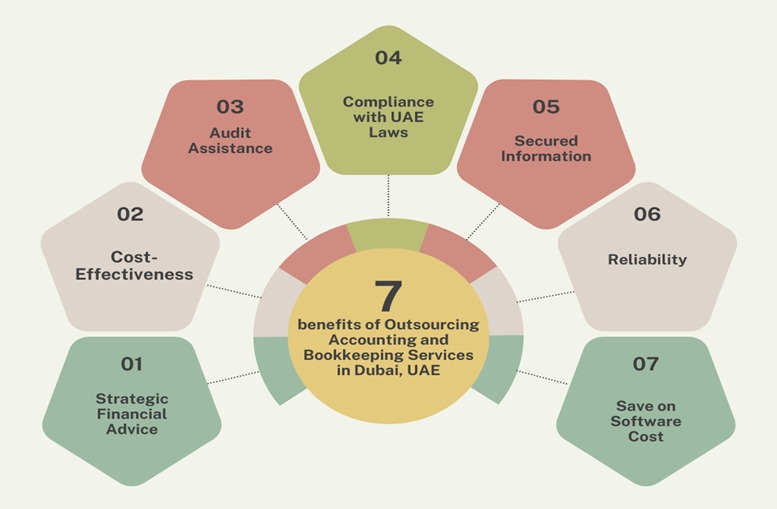

Benefits of Outsourcing Accounting and Bookkeeping Services in Dubai UAE:

- Cost-Effectiveness: Elevate’s offering goes beyond mere cost-effectiveness; it is a strategic arrangement that allows businesses to channel their focus into core operations while benefiting from the specialized skills of a dedicated accounting team.

- Compliance with UAE Laws: The UAE Federal Law No-2 of 2015 mandates stringent accounting practices. Elevate ensures that its clients’ financial records not only comply with these laws but also mitigate the risk of legal complications, providing a secure foundation for financial operations.

- Experienced Team: Elevate’s team comprises seasoned professionals with more than a decade of experience in the UAE market. They are well-versed in handling intricate accounting systems and proficiently operate popular accounting software such as QuickBooks, ZOHO, ODOO, XERO, and Tally ERP.

- Strategic Financial Advice: Elevate transcends the role of a conventional accounting service provider by offering strategic financial advice. This valuable input empowers businesses to make informed decisions, facilitating not just compliance but also sustainable growth.

- Flexibility: In the fast-paced world of business, flexibility is paramount. By entrusting your accounting system to Elevate, you gain the advantage of a flexible approach. Leveraging cloud-based software, we ensure that you have seamless access to your accounting and financial information at any time and from anywhere. This flexibility empowers you to make informed decisions on the go, contributing to the agility and responsiveness of your business operations.

- No Hiring Costs: Transferring your bookkeeping to an outsourcing model presents a substantial cost-saving opportunity. Instead of allocating resources to hire and maintain an in-house accounting team, you can redirect these funds towards revenue-generating roles within your organization. This strategic reallocation of resources not only optimizes your budget but also enhances overall business productivity.

- Secured Information: The security of your sensitive accounting data is our top priority. Elevate ensures that your financial information is securely stored on robust servers, minimizing the risk of data loss. This commitment to data security not only protects your valuable information but also ensures business continuity, allowing you to operate with confidence knowing that your data is in safe hands.

- Reliability: The leaving of a key accounting personnel from a company can disrupt day-to-day operations and pose a risk to the loss of crucial knowledge and experience. With outsourced accounting services from Elevate, this risk is mitigated. Our reliable team ensures continuity in your financial processes, safeguarding against interruptions and maintaining the consistency necessary for the smooth functioning of your business.

- Audit Assistance: Navigating the external auditing process can be a time-consuming task for business owners. As your trusted Outsourced Accounting Company, elevate takes the responsibilities by presenting the book of accounts to auditors and facilitating the auditing process. This not only streamlines the audit but also allows business owners to focus on core operations without the added burden of extensive interactions with auditors.

- Expert Benefits: Elevate offers a range of expert benefits at competitive rates. Our packages, available on a monthly, quarterly, and yearly basis, ensure that you receive the highest quality professional services. With access to the latest and updated software, our expert team goes beyond traditional accounting services. We extend our expertise to support you in developing business plans, conducting feasibility studies, and providing part-time CFO services, all at highly competitive prices.

- Save on Software Cost: Optimizing costs is a key aspect of strategic financial management. By outsourcing your accounting needs to Elevate, you eliminate the need to purchase expensive accounting software. The funds saved on software costs can be redirected towards hiring a permanent employee for revenue-generating roles, further enhancing the financial efficiency of your business.

Example:

Consider a hypothetical small or medium-sized business in Dubai that initially records transactions in non-accounting software like Microsoft Excel. By outsourcing their accounting needs to Elevate, this business gains access to a team of experts capable of seamlessly transitioning their financial records to advanced accounting software. This not only ensures professional maintenance of accounts but also eliminates the need for additional expenditures on accounting software.

Without Outsourcing:

- Limited Expertise: The in-house team lacked specialized knowledge, leading to difficulties in keeping up with evolving accounting standards and tax regulations.

- Lack of Supervision to check the correctness of the accounting report generally business owners lacks when they have one in house accountant .

- Resource Misallocation: Non-core tasks like bookkeeping diverted valuable time and energy from activities contributing directly to revenue generation and business expansion.

- Increased Costs: Internal management of accounting functions led to higher operational costs, including investments in training programs for software and regulatory updates.

- Compliance Risks: Lack of dedicated expertise increased the risk of non-compliance with UAE financial laws, potentially resulting in legal repercussions and fines.

- Business Continuity Challenges: The job change of a key employee disrupted day-to-day operations, highlighting the risk of losing institutional knowledge and experience.

With Outsourcing to Elevate Accounting & Auditing:

- Specialized Expertise: Elevate’s team provided specialized knowledge, ensuring adherence to accounting standards and tax regulations.

- Supervision by Accounts Manager – At Elevate we have Senior mangers who reviews all the accounting reports prepared by any accountant to ensure the accuracy & correctness.

- Resource Optimization: Outsourcing freed up in-house resources for core activities, enhancing productivity and revenue-generating potential.

- Cost Efficiency: Outsourcing proved more cost-effective than internal management, eliminating the need for extensive training programs.

- Compliance Assurance: Elevate’s expertise ensured compliance with UAE financial laws, mitigating the risk of legal repercussions.

- Business Continuity Planning: Elevate’s dedicated team ensured smooth operations even in the absence of key in-house personnel, minimizing disruptions.

This streamlined example illustrates how outsourcing to Elevate Accounting & Auditing addresses key drawbacks and provides tangible benefits for the business.

Why Outsource Bookkeeping to Elevate Team?

Mandatory Requirements: Free zones in the UAE, including DIFC, Dubai Mainland, and DMCC, necessitate companies to maintain comprehensive financial records and undergo audits. Elevate, as one of the preeminent accounting firms in Dubai, not only ensures compliance with these requirements but goes a step further to streamline the process.

Focus on Business Expansion: Outsourcing to Elevate is not merely a delegation of tasks; it is a strategic decision that allows businesses to concentrate on expanding their core operations. With Elevate managing accounting, bookkeeping, auditing, and VAT compliance, businesses can navigate growth with confidence.

Financial Evaluation: Elevate provides more than just accounting services; they offer an in-depth evaluation of the financial well-being of businesses. This comprehensive assessment serves as a roadmap for strategic planning and financial optimization.

In conclusion, Elevate Accounting & Auditing emerges as a beacon of reliability for businesses seeking and best accounting services in Dubai. Their unwavering commitment to industry standards, a team of seasoned professionals, and a holistic suite of services position them as the partner of choice for businesses aspiring to achieve financial excellence and sustainable growth in the dynamic landscape of Dubai.

WHAT WE DO?

- Preparing Financial Statements.

- Managing Cost.

- Computerized accounting system analysis and installation.

- Budgeting & Financial Forecasting.

- Managing Accounts Receivable.

- Managing Accounts Payables.

- Verification and valuation of inventory.

- Preparation of monthly bank reconciliation statements.

- Payroll Processing.

- Banking and Credit card reconciliation.

- Supervision & review of financial accounting records.