In the bustling business landscape of the United Arab Emirates (UAE), small and medium-sized enterprises (SMEs) are the lifeblood, contributing significantly to the economy.

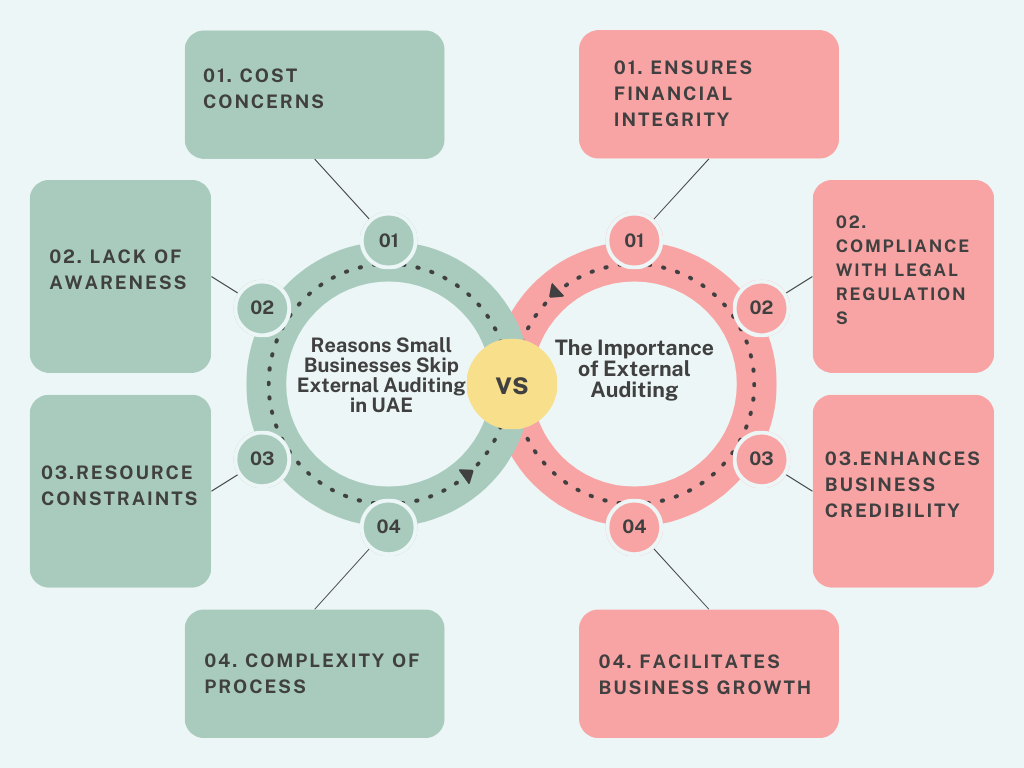

However, despite their vital role, many SMEs in the UAE tend to sidestep external audits, neglecting proper accounting practices, and underestimating the value an audit can bring to their business.

Here’s a comprehensive look at why small businesses often avoid external audits in the UAE:

- Neglecting Accounting Practices: Small businesses frequently overlook the importance of maintaining accurate accounting records. In the rush to manage day-to-day operations, they prioritize immediate needs over long-term financial health. Without proper bookkeeping, it becomes challenging to track financial transactions, leading to discrepancies and potential errors.

- Cost Concerns: One of the primary reasons small businesses shy away from external audits is the perceived increase in costs. Hiring an external auditor may seem like an unnecessary expense, especially when trying to manage tight budgets. Many business owners fail to recognize that the benefits of an audit far outweigh the initial investment.

- Misconceptions About Outsourcing: There’s a common misconception among small business owners that outsourcing accounting tasks is not feasible or reliable. They hesitate to trust external parties with sensitive financial information, fearing a loss of control or confidentiality breaches. However, outsourcing to a reputable accounting firm can provide expert guidance and alleviate the burden of managing finances internally.

- Fear of Complexity: Navigating the intricacies of UAE’s regulatory framework can be daunting for small businesses. The fear of compliance requirements and legal obligations often leads to avoidance rather than proactive engagement. However, partnering with experienced auditors familiar with local regulations can streamline the process and ensure adherence to standards.

- Lack of Awareness: Many SME owners in the UAE are unaware of the benefits that external audits offer beyond regulatory compliance. They view audits as a mere formality rather than a strategic tool for business improvement. Educating small business owners about the value of audits in enhancing financial transparency and credibility is crucial for fostering a culture of accountability.

- Perception of Auditors as Adversaries: Some small business owners perceive auditors as adversaries whose sole purpose is to scrutinize and criticize their financial practices. This adversarial mindset hampers collaboration and prevents businesses from leveraging audit findings to identify areas for improvement. Establishing a positive relationship with auditors based on trust and transparency is essential for maximizing the benefits of an audit.

- Overlooking Long-Term Benefits: Small businesses often prioritize short-term gains over long-term sustainability. They fail to recognize that undergoing external audits can enhance their reputation, attract investors, and facilitate future growth opportunities. By investing in regular audits, businesses can build a solid foundation for success and mitigate risks effectively.

Don’t skip annual External Audits in Dubai: Here’s Why You Shouldn’t Skip Them

Skipping annual external audits in Dubai is a common oversight for many companies, often reserved for legal obligations or banking requirements. However, audit firms in Dubai, UAE stress the importance of voluntary audits, highlighting numerous benefits that extend beyond mere compliance.

An annual audit serves as the pinnacle of financial assurance for businesses, offering invaluable insights and advantages:

- Adding Value to Your Business: An annual audit strengthens internal controls, attracting stakeholders and investors, and facilitating improved decision-making, future growth, and superior business practices.

- Enhancing Credibility: Audited financial statements bolster a company’s credibility, essential for fundraising, growth initiatives, and securing trust from banks, governments, and other lenders.

- Improving Internal Systems and Controls: Auditors in Dubai offer a fresh perspective, enabling comprehensive analysis of systems and processes, and leading to recommendations for enhancements and improvements.

- Identifying Weaknesses & Risks: Annual audits pinpoint inherent weaknesses and risks, allowing for proactive measures and risk mitigation, crucial for minimizing potential business threats.

- Boosting Shareholder Confidence: Independent reviews through external audits provide shareholders with peace of mind, ensuring transparency and integrity, particularly crucial for absentee shareholders.

- Attracting Investors: Investors prioritize transparency and reliability, making audited financial statements a key factor in attracting investment and fostering investor confidence.

- Discovering Errors and Ensuring Compliance: Annual audits uncover accounting errors, ensuring accuracy and adherence to accepted standards, while also guaranteeing compliance with evolving regulatory requirements such as VAT, AML-CFT, ESR, and UBO.

Feeling lost in the world of External Auditing in UAE? Don’t sweat it, because Elevate’s got your back!

13 years of solid experience, a team of top-notch Chartered Accountants and Business Consultants – that’s Elevate for you. When you team up with Elevate, say goodbye to auditing worries. We handle everything smoothly, delivering timely audits and understanding exactly what you need.

Meet our superhero auditors – they bring independence, quality, and insights that are pure gold.

We respect your time as much as we value quality. Our audits are not just thorough but also done on time, every time. Speaking of standards, we’re not just good – we’re the best. Our procedures follow the top industry practices and international standards. And guess what? Our prices are pocket-friendly! You get top-notch service without breaking the bank.

Oh, and did we mention it?

We’re approved auditors in both the mainland and the Freezone.