How Accounting Services is improtant for restaurant Business in UAE?

Your love for food may have gotten you into the restaurant business, but the only thing that’s going to let you stay there is being able to pay all your dues on time while keeping the funds available for the profit share of the shareholders. For this you need to know that behind every good business there is a great accounting system. If You looking for accounting outsourcing companies in Dubai Elevate Accounting & Auditing is right place who provide best quality services.

Where money is being spent and exactly how much, the sources of your revenue, and how much income is needed in order to turn a profit or to cross break-even point.

The end goal — more money is coming in than going out – is simple, but getting there is much more complex. Restaurant accounting involves tracking massive amounts of real data as well as industry benchmarks. It has its own language of KPIs, EBITDA and COGS. In the end, accounting is not only incredibly time-consuming but also time-sensitive. And it’s dependent on 100% accuracy as one wrong decimal point can sink your books.

Take a deep breath: Entrepreneurs naturally wear many different hats in their business. However, it is impossible to be an expert at everything. As a business owner, you need to keep a very close eye on the day to day business transactions and which is why you hire bookkeeper or accountant who is capable of handling your accounts.

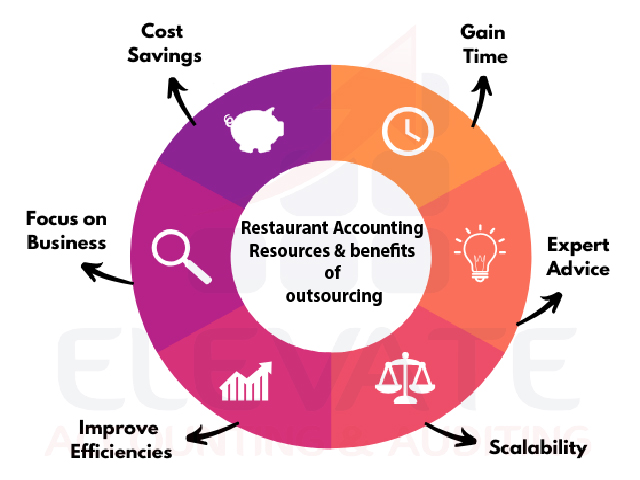

Restaurant Accounting Resources & benefits of outsourcing in Dubai, UAE

Bookkeepers and Accountants:

You’re probably thinking it’s time to call in the professionals, but do you need to seek out a bookkeeper or a Certified Public Accountant?

Bookkeepers can assist you in tracking your data, keeping records and ledgers of specifics such as accounts payable, payroll, etc. Meanwhile CPAs are trained to provide in-depth operational analysis, tax consultancy and also ensuring that you are complying with appropriate accounting standards and controls as well as the local business related laws.

Elevate Accounting & Auditing a reputed Accounting company has developed a unique mechanism to handle Restaurant Accounting and Book Keeping. Elevate has a team of highly experienced in special restaurant and food chain for managing their finance.

Elevate is successfully managing many small and huge restaurant’s complete finance. Restaurant owners those used to struggle to manage their accounts and finance are happy to outsource to Elevate.

Accounting Software:

Accounting Software is an additional overhead cost for a restaurant owner. Fortunately some of the sound work of accounting can be automated through software that tracks and generates reports of accounts receivable and payable, banking, payroll, and inventory management.

You’ll want to consider whether it’s important for the program to be accessible online from any location or from your smart phone,how intuitive it is to use, and whether it can integrate with your restaurant’s POS system and other software that manages scheduling. You’ll also want one that connects to your business bank account and can automatically import your transactions each day so you don’t have to perform this task manually.

Don’t know where to start? If you are outsourcing your accounting companies in Dubai with Elevate Business Solutions , they use some popular accounting software include Microsoft Dynamics, Quickbooks , Xero, Tally ERP9, and Sage 50. This completely depends on the business volume and type of report the management needs. By outsourcing to Elevate Business Solutions you can save the cost of buying one software.

External and Internal Auditing of Restaurant :

External auditors: They are responsible for auditing the restaurant’s financial statements and providing reasonable assurance that they are presented fairly and in conformity with IFRS and that they reflect true representation of the restaurant’s financial position and results of operations. Auditors are also required to express an opinion on the effectiveness of the design and operations. The external audit function is intended to lend credibility to financial reports and reduce information risk that financial reports are biased, misleading, inaccurate, incomplete, and contain material misstatements that were not prevented or detected by the accounting department.

Internal auditors: They support management’s efforts to establish a culture that embraces ethics, honesty, and integrity. They assist management with the evaluation of internal controls used to detect or mitigate fraud, evaluate the organization’s assessment of fraud risk, and are involved in any fraud investigations. Although it is management’s responsibility to design internal controls to prevent, detect, and mitigate fraud, the internal auditors are the appropriate resource for assessing the effectiveness of what management has implemented. At Elevate there is an experienced team to act like a smart internal auditor. They pay several surprise visits to the restaurant to ensure there is no mismanagement.

Vishal Malhotra

(Mob: +971(0)567186351)

Email Id:vishal@elevateauditing.com