Payroll & HR Process Consultancy

Home : Payroll & HR Process Consultancy

Let's Talk

Free Consultation

Let's Talk

Free Consultation

By outsourcing your payroll services, you can ensure:

- Efficient and secure management of data.

- Confidentiality of employee salaries and benefits through unique identification codes.

- Reduced labor costs and mitigation of risks associated with computations.

Payroll Process in UAE

Ensure flawless payroll management with the expert payroll service provider.

Renowned for delivering top-notch payroll solutions in the UAE and beyond, Elevate Accounting & Auditing offers:

- Streamlined transactions facilitated by unique features

- Unlimited personal, positional, and Payroll masters

- Support for multiple currencies and companies

- Flexible payroll policy customization at company, entity, or employee levels

- Compliance with GCC WPS standards

- Customizable daily rate policies

- Overtime and employee loan management with user-defined rates

- Seamless integration of payroll with JV GL

- Off-cycle payroll processing

- Management of employee loans, advances, air tickets, and leave passages

- Accrual of gratuity and management of employee benefits

- Robust leave and compensatory off-management

- Salary hold/release and suspension capabilities

- Integration with web services for enhanced functionality

Elevate Accounting & Auditing offers an extensive array of reports as part of its Payroll Processing Services, including:

- Payroll register

- Wage Protection System (WPS) reports

- Payroll reconciliation statements

- Detailed overtime reports

- Indemnity accrual registers

- Reports on outstanding employee loans

- Pension reports

- Payroll JV summaries

- Cash and bank transaction reports

- Leave balance statements

- Comprehensive payroll summaries

- Customized reports tailored to specific business requirements

HR Business Process Outsourcing in the UAE

Outsourcing has become commonplace as it contributes to the overall advancement of organizations while minimizing the time and resources expended by in-house HR professionals. The HR business process encompasses various functional areas. Why do organizations opt to outsource HR functions? It assures specialized and experienced services from professionals in a more structured manner. Opting to outsource an entire business process, rather than just a portion of it, has demonstrated greater utility for organizations. The HR business process encompasses various functional areas, including recruitment, training, payroll, and performance management. This strategic decision enables companies to focus on core competencies while leveraging the expertise of external providers to enhance overall organizational performance.

Advantages of HR Outsourcing in the UAE

Outsourcing your HR processes to a reputable consultancy brings forth numerous benefits, with the major ones including:

- Reduction in costs and risks

- Ensuring compliance with laws

- Access to advanced HR IT systems

- Increased flexibility and responsiveness

- Utilizing the support of a team of experts

- Streamlining hiring and orientation procedures

- Fostering employee engagement

- Facilitating the retention of top talent and attraction of new ones

- Cultivating an enhanced workplace culture, training, and development

- Access to superior benefits packages at reasonable rates

Frequently Asked Questions

What are the statutory pay components included in employee salary in the UAE?

What is the minimum salary payable in the UAE?

How is overtime calculated in the UAE?

Overtime pay is calculated based on the employee’s Basic Wage, with an additional 25% for extra hours beyond normal working hours. If overtime falls between 10 p.m. to 4 a.m. or on a designated rest day, higher rates apply.

If the circumstances require the worker to work on his off-day, as specified in the labour contract, or work regulations, then the worker will be entitled to a substitute rest day, or to a pay equal to normal working hours’ remuneration (which is based on basic salary) plus 50 per cent of that pay.

How is UAE gratuity accrued and paid?

Gratuity is accrued based on the last drawn basic salary, calculated at 21 days’ pay for each year of service for the first five years, and 30 days’ pay for each additional year. It is payable upon completion of one year or more in continuous service.

Note:– If a worker has served for less than 1 year, he is not entitled to any gratuity pay.

What are the statutory deductions made to employees in the UAE?

While income tax isn’t applicable, UAE nationals contribute to mandatory national pension plans.

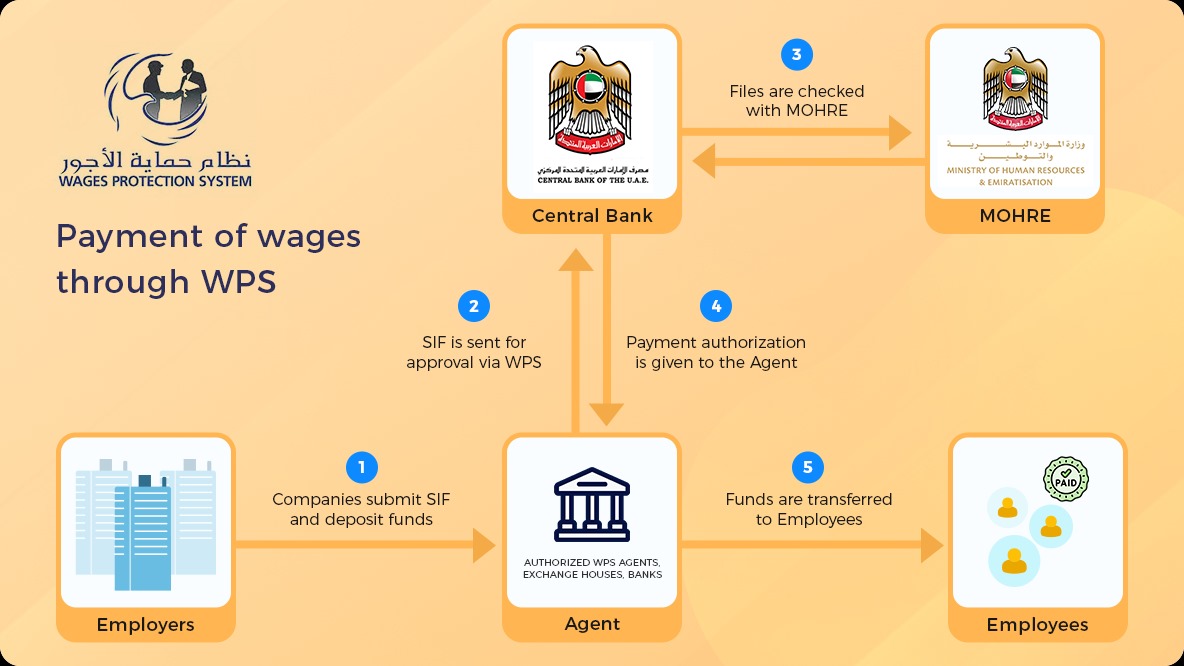

What is UAE WPS (Wage Protection System)?

UAE WPS is an electronic salary transfer system ensuring timely and full wage payments to employees in the private sector, monitored by the Ministry of Human Resources and Emiratization.

What types of employment contracts are available in the UAE?

Employment contracts in the UAE are typically for a specific term not exceeding two years, renewable upon mutual agreement.

Are employees eligible for air ticket benefits in the UAE?

In the UAE, providing air ticket benefits to employees is not mandatory. However, employers may offer this as part of their benefits package if they choose to do so.

What is the leave policy defined under the labor law in the UAE?

Leave policies include annual leave, sick leave, maternity leave, study leave, bereavement leave, sabbatical leave, hajj and Umrah leave and paternity leave.

Is employee medical insurance mandatory in the UAE?

Yes, employers must provide medical insurance for employees during their employment tenure.

Which currencies can be used in making salary payments in the UAE?

Salaries are typically paid in UAE Dirham, although other currencies can be agreed upon in the employment contract.

Is bonus or incentive payment mandatory in the UAE?

No, bonus and incentive payments are not mandatory, though many companies offer them as part of their compensation packages.

What items are included in the End of Service Benefits calculation in the UAE?

End of Service Benefits typically include gratuity, repatriation tickets (if applicable), notice period pay (if applicable), unused leave pay, and any other outstanding payments or deductions.

Reach out to our expert team for complete assistance related to Payroll Outsourcing Services in UAE

Get started with your business needs, we reach out with free and qualified guidance